Where Believers become Billionaires

Deposit

ETH's Advantages

ETH, the second-largest cryptocurrency by market cap, offers a stable price less susceptible to speculation, providing a reliable choice for investors.

ETH has wide applications, including lending platforms, liquidity staking, restaking, yield, and NFT marketplace.

The ETH spot ETF approved in May, increasing investment diversity and allowing investors more flexibility in the market.

Combining these factors, ETH is expected to continue its upward trend, offering investors substantial returns.

Product Features

Monthly Dividends

After users deposit ETHs, they can view their available interest for withdrawal on the interface every 30 days. Interest is disbursed in USDT and does not affect the accumulation of investment time. The initial interest rate is 2% for the first month, increasing by 0.2% every subsequent month, with a maximum accumulation period of one year, allowing for a total interest withdrawal of 37.2%. Interest can be withdrawn at any time, providing flexibility for users.

No time lock

In the past, DeFi projects were designed with high APY, often accompanied by relatively high entry barriers, such as requiring a certain amount of token to be deposited or imposing time lock requirements, or even just for early participants. However, by leveraging our own resources, we are able to break free from these limitations and offer participants a unique DeFi experience without imposing time constraints.

Referral Program

We offer relatively favorable rewards to users willing to refer our project to others. Whenever the referred participant withdraws dividends, the referrer's interest available for withdrawal will increase by 10% of the dividends withdrawn by the referred participant, with no limit.

Monthly Dividends

After users deposit ETHs, they can view their available interest for withdrawal on the interface every 30 days. Interest is disbursed in USDT and does not affect the accumulation of investment time. The initial interest rate is 2% for the first month, increasing by 0.2% every subsequent month, with a maximum accumulation period of one year, allowing for a total interest withdrawal of 37.2%. Interest can be withdrawn at any time, providing flexibility for users.

No time lock

In the past, DeFi projects were designed with high APY, often accompanied by relatively high entry barriers, such as requiring a certain amount of token to be deposited or imposing time lock requirements, or even just for early participants. However, by leveraging our own resources, we are able to break free from these limitations and offer participants a unique DeFi experience without imposing time constraints.

Referral Program

We offer relatively favorable rewards to users willing to refer our project to others. Whenever the referred participant withdraws dividends, the referrer's interest available for withdrawal will increase by 10% of the dividends withdrawn by the referred participant, with no limit.

News and Community Articles Product Investment Strategy Aggressive Investment Opportunities

DLNews

Ethereum to $5,000? Nine experts on how the ETF approval will impact prices

Will Ethereum break records in June?

We checked in with nine experts on their views on the market as ETF approval approaches.

We checked in with nine experts on their views on the market as ETF approval approaches.

Coin68

Ethena là gì? Giải pháp phát hành stablecoin phi tập trung trên Ethereum

Ethena là dự án được phát triển để giải quyết các vấn đề của các stablecoin đang có trên thị trường tiền mã hoá. Vậy dự án này có gì đặc biệt, các bạn hãy cùng Coin68 tìm hiểu thông qua bài viết này nhé!...

DL News

EigenLayer users can claim tokens now, but won’t be able to cash in for months

EigenLayer users began claiming a share of the protocol’s 1.6 billion tokens Friday.

But the tokens won’t be transferable for several more months, making immediate their valuation difficult.

But the tokens won’t be transferable for several more months, making immediate their valuation difficult.

DL News

Why Ethereum ETFs will see $3.9bn inflows in first 100 days

Ethereum ETFs are on the cusp of hitting the market, says CCData analyst.Outflows from popular products could hamper a rise in prices.

Coin68

Các mạng Layer-2 Ethereum ghi nhận kỷ lục 7 triệu ví hoạt động trong 1 tuần

Trong khi ETF Ether vừa được SEC phê duyệt sơ bộ, các mạng Layer 2 Ethereum đón tin vui với kỷ lục mới ghi nhận về số lượng ví hoạt động hàng tuần.

DL News

Tether and Circle add $1.3bn in a single day as Ether ETF odds improve

Theo đơn đăng ký của họ, quỹ ETF đề xuất của Franklin Templeton nhằm cung cấp cho các nhà đầu tư một lựa chọn thuận tiện thay vì phải trực tiếp mua, giữ và giao dịch Ethereum.

Bước đi này đến sau khi Ủy ban Chứng khoán và Giao dịch (SEC) phê duyệt các nhà phát hành cho các quỹ ETF Bitcoin vào đầu tháng Một. Franklin Templeton là một trong số gần một tá công ty ra mắt sản phẩm như vậy...

Bước đi này đến sau khi Ủy ban Chứng khoán và Giao dịch (SEC) phê duyệt các nhà phát hành cho các quỹ ETF Bitcoin vào đầu tháng Một. Franklin Templeton là một trong số gần một tá công ty ra mắt sản phẩm như vậy...

Coin68

ETF Ethereum spot – Bước ngoặt lớn cho thị trường crypto?

Vài ngày vừa qua, thị trường crypto đã xuất hiện dấu hiệu hồi phục tương đối mạnh mẽ trở lại sau những tín hiệu khởi sắc xoay quanh ETF Ethereum spot từ Uỷ ban Chứng khoán và Giao dịch Hoa Kỳ - SEC. Diễn biến này...

Saigon TradeCoin

Ethereum Layer-2 TVL đạt $21b, mức cao nhất từ trước đến nay.

Tổng giá trị của tài sản bị khóa (TVL) trên các mạng layer 2 của Ethereum (ETH) đã vượt qua mức 20 tỷ đô la, đạt đỉnh cao lịch sử 21 tỷ đô la...

DLNews

Vitalik Buterin’s 22-minute proposal set to go live in next Ethereum upgrade

Puffer Finance, the latest entrant to the rapidly-growing liquid restaking sector, has amassed over $135 million worth of Ether deposits in the 24 hours since its launch.

The protocol’s soaring deposits rank it as the fifth-largest liquid restaking provider behind ether.fi, Kelp DAO, Renzo and Eigenpie...

The protocol’s soaring deposits rank it as the fifth-largest liquid restaking provider behind ether.fi, Kelp DAO, Renzo and Eigenpie...

Coin68

Memecoin “nhảy múa” theo hiệu ứng ETF Ethereum spot

A new Ethereum Layer 2 network, Zircuit, enables the staking of restaked and staked Ether.

Yes, you read that right.

Over $128 million has already been deposited in Zircuit since deposits opened in the last 24 hours, all before Zircuit’s mainnet has even gone live...

Yes, you read that right.

Over $128 million has already been deposited in Zircuit since deposits opened in the last 24 hours, all before Zircuit’s mainnet has even gone live...

Saigon TradeCoin

Bitcoin, Ethereum tăng giá sau báo cáo về lạm phát của Mỹ.

Sau khi thông tin về tỷ lệ lạm phát của Mỹ trong tháng 4 được công bố, giá của Bitcoin và Ethereum đã trỗi dậy mạnh mẽ. Đồng tiền ảo Bitcoin và nhiều cổ phiếu đã trải qua một đợt tăng giá đáng chú ý.

News and Community Articles Product Investment Strategy Aggressive Investment Opportunities

DLNews

Ethereum to $5,000? Nine experts on how the ETF approval will impact prices

Will Ethereum break records in June?

We checked in with nine experts on their views on the market as ETF approval approaches.

We checked in with nine experts on their views on the market as ETF approval approaches.

Coin68

Ethena là gì? Giải pháp phát hành stablecoin phi tập trung trên Ethereum

Ethena là dự án được phát triển để giải quyết các vấn đề của các stablecoin đang có trên thị trường tiền mã hoá. Vậy dự án này có gì đặc biệt, các bạn hãy cùng Coin68 tìm hiểu thông qua bài viết này nhé!...

DL News

EigenLayer users can claim tokens now, but won’t be able to cash in for months

EigenLayer users began claiming a share of the protocol’s 1.6 billion tokens Friday.

But the tokens won’t be transferable for several more months, making immediate their valuation difficult.

But the tokens won’t be transferable for several more months, making immediate their valuation difficult.

DL News

Why Ethereum ETFs will see $3.9bn inflows in first 100 days

Ethereum ETFs are on the cusp of hitting the market, says CCData analyst.Outflows from popular products could hamper a rise in prices.

Product Investment Strategy

70%

30%

Aggressive Investment Opportunities

Steady Income Investment Opportunities

Product Investment Strategy

70%

30%

Aggressive Investment Opportunities

Steady Income Investment Opportunities

Restaking 20%

Alt 15%

Stablecoin 10%

Price gap 25%

Mining 30%

Click on each color bar to see details

Comparison

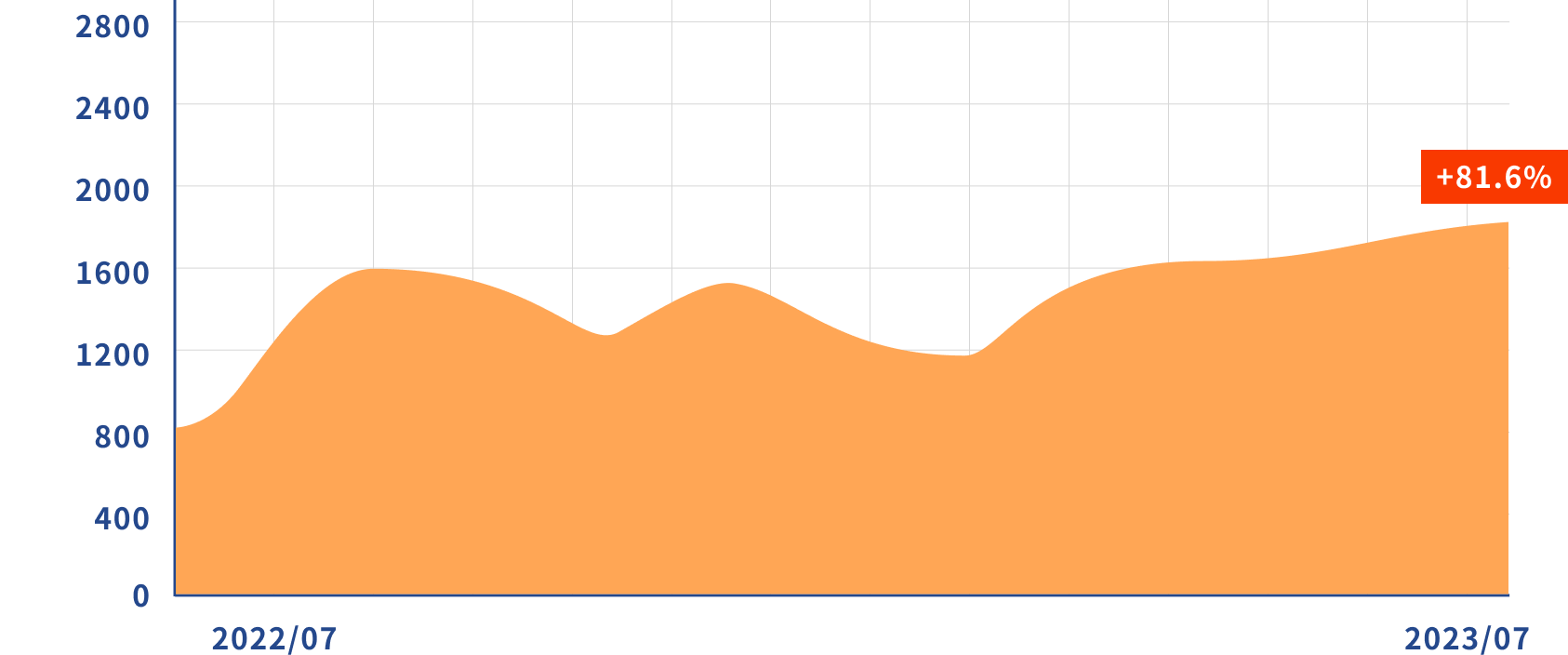

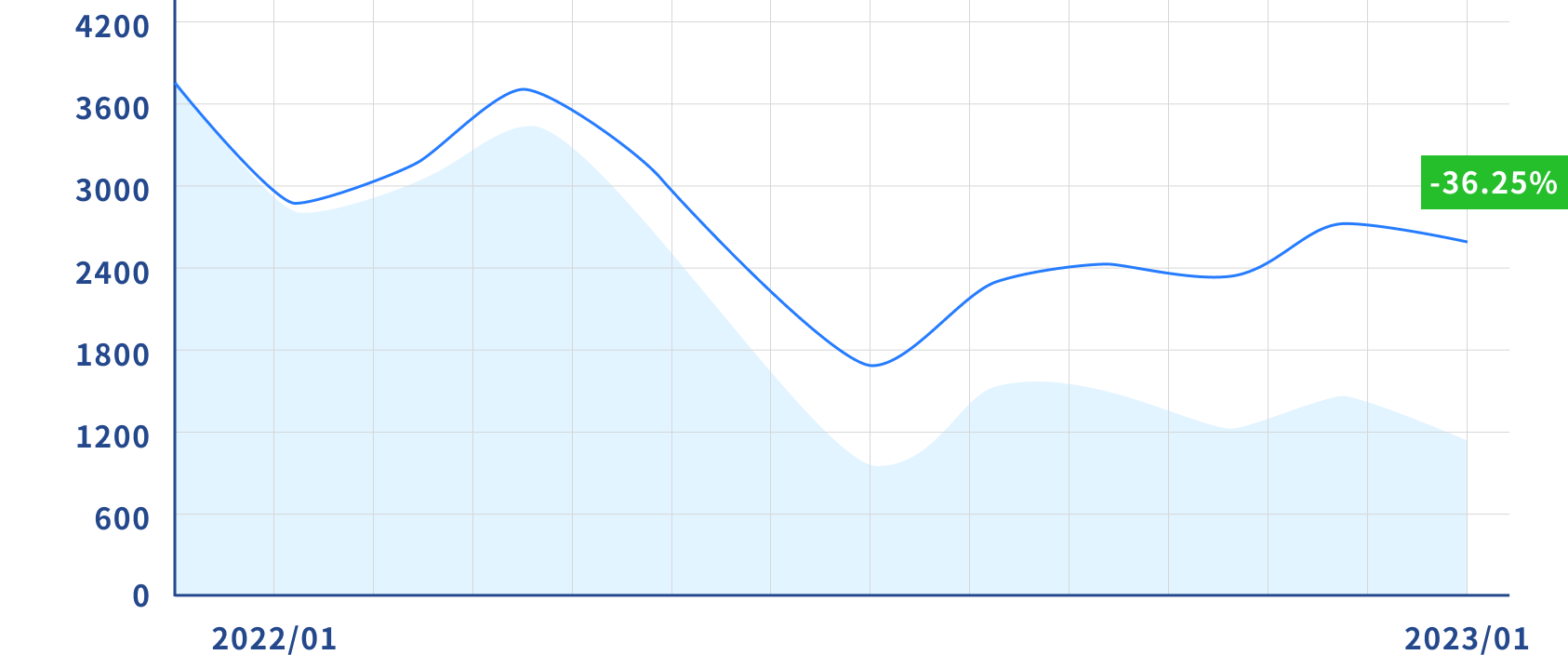

From July 2020 to July 2023, ETH rose by 81.6%.

From July 2020 to July 2023,

ETH rose by 81.6%.

ETH rose by 81.6%.

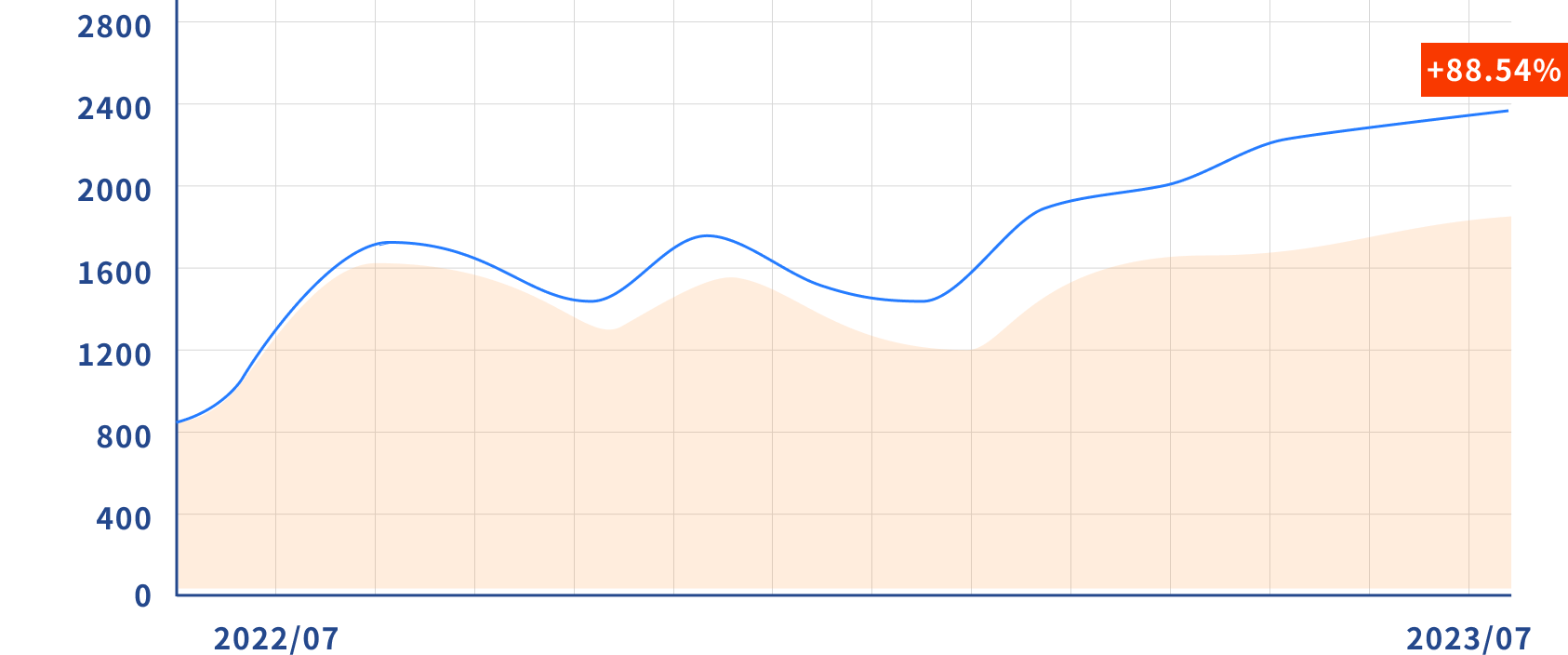

Investing in OinETH could result in an increase of up to 88.54%.

Investing in OinETH

could result in an increase of up to 88.54%.

could result in an increase of up to 88.54%.

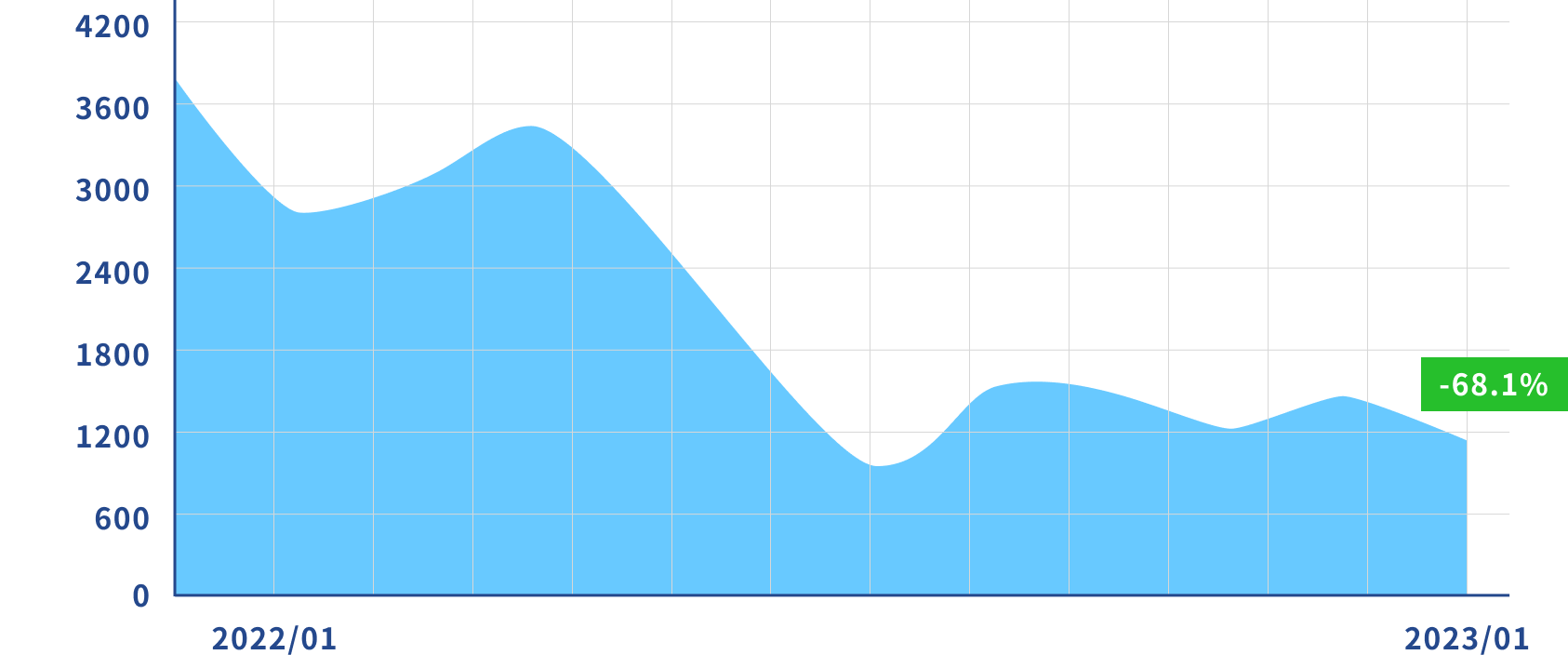

From January 2022 to January 2023, ETH fell by 68.1%.

From January 2022 to January 2023,

ETH fell by 68.1%.

ETH fell by 68.1%.

If you invest in OinETH, the decrease would be only 36.25%. Calculate

If you invest in OinETH,

the decrease would be only 36.25%. Calculate

the decrease would be only 36.25%. Calculate

Calculate investment

ETH

Month

USDT

Designed by Halink Web